Your overall health is important to us, and the university offers a variety of benefits to help support your physical and mental health. University of Louisville offers four health plans through Anthem Blue Cross Blue Shield. Who we areAnthem, Inc. is one of the largest health benefits companies in the United States. With local service and the value of the Blue Cross brand, we have been committed to ensuring our members have access to affordable health benefits for over 80 years. Sharp Health Plan continues to be recognized in California and nationally for their high-quality care and service. They are the highest member-rated health plan in California, and they also hold the highest member ratings for health care, personal doctor and specialist among reporting California health plans.

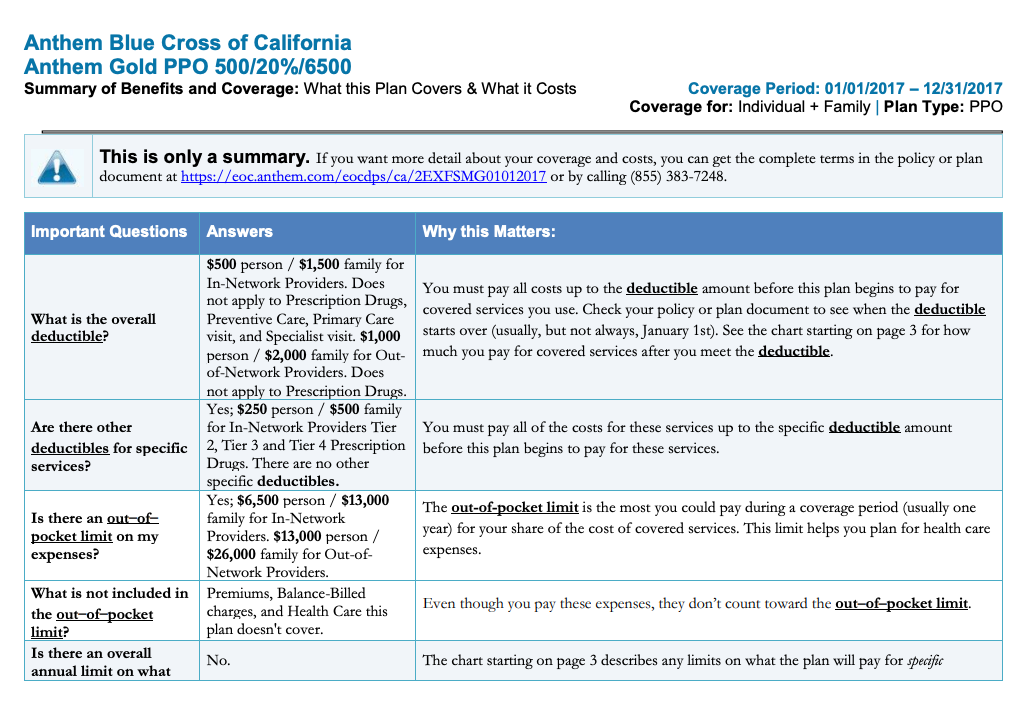

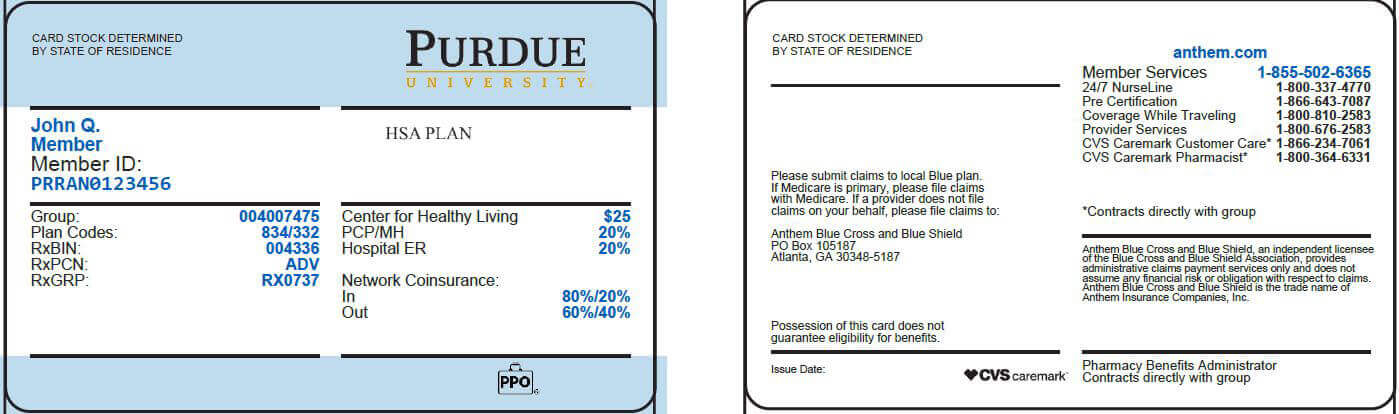

As part of Sharp HealthCare's integrated delivery system, Sharp Health Plan directly connects members to an expansive network of nationally recognized doctors, elite-rated medical groups and hospitals. This plan combines traditional medical coverage with a Health Savings Account . Under this plan, all covered services (except preventive services/prescriptions) are subject to the annual deductible. The deductible is a dollar amount of out-of-pocket costs you must pay each year before the plan will begin paying its share of your healthcare expenses. The nice thing about this plan is that you can pay for that deductible using the tax-free funds in your HSA. Once the deductible has been met, most in-network services are covered with a 20% coinsurance.

Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do.

If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Once funds are deposited into your HSA, those funds can be used to pay for qualified medical expenses tax-free, even if you no longer have high-deductible health plan coverage. The funds in your account automatically roll over each year and remain in the account indefinitely until used.

Once you discontinue coverage under a high-deductible health plan and/or get coverage under another health plan that disqualifies you from an HSA, you can no longer make contributions to your HSA. However, since you own the HSA, you can continue to use it for future qualified medical expenses. If you're an HMO member, you will need to receive services from an in-network HMO provider. However, you will be able to receive emergency or urgent care services no matter where you are. For details about your coverage, please review your Blue KC certificate, which outlines the benefits and exclusions related to your health insurance plan.

You can view your certificate by logging in and accessing the Plan Benefit section. However, not all small, independent pharmacies have the correct computer system to validate your transaction, in which case you'll need to pay for the prescription using another form of payment. In 2004, WellPoint Health Networks Inc and Anthem, Inc. merged and became the nation's leading health benefits company. In December 2014 WellPoint Inc. changed its corporate name to Anthem, Inc. Anthem has about 40 million members and is ranked 33rd on the Fortune 500.

To enroll in a high-deductible health plan, complete the Blue KC application process. The Blue-Saver® PPO health insurance plan is a high-deductible health plan that allows you to establish an HSA as part of your health benefits. When you enroll in the Blue Saver plan, you may be offered the opportunity to establish a HSA with one of our preferred banks. You will be presented with appropriate banking authorizations and disclosures necessary for Blue KC to work with the bank that will establish your HSA. Please note all financial institutions offering HSA products must comply with the USA Patriot Act, requiring your HSA bank to collect and verify information about you when processing your HSA application. Once your HSA has been established, you will be mailed a welcome kit and HSA debit card from the bank.

A qualified health-deductible health plan is a health plan with an annual deductible for an individual or a family that meet the minimum deductible amount published annually by the U.S. The annual out-of-pocket expenses required by the high-deductible health plan also does not exceed the out-of-pocket maximums published by the U.S. Out-of-pocket expenses include deductibles, copayments and other amounts the member must pay for, but do not include premiums or amounts incurred for non-covered benefits. A Health Savings Account allows members enrolled in a qualified high-deductible health plan to contribute funds on a tax-free basis into the member's account. A member's employer may also contribute funds to the account.

These funds are used for payment of qualified medical expenses as defined by the IRS. Unused funds in an HSA roll over in the member's account at the end of each calendar year. You pay 20% of the cost for all specialist office visits after you meet the annual deductible. Your specialist may charge you up to the full amount of your deductible at the time of service, and you may need to file a claim to get reimbursed.

You can visit any provider or specialist of your choice without preauthorization from your primary care doctor. Because of its large network of providers, giving you many choices for where you get medical services. Anthem has a variety of health insurance plans available including options for individuals, families, Medicare, Medicaid and group insurance. After the funds in your PCA have been used, you will be responsible for a certain amount of your healthcare costs until your deductible amount has been met. You do have the benefit of the negotiated prices for healthcare from network providers, but you will pay for all of the healthcare until your individual or family deductible is met. Each payment you make for covered healthcare services you've received from your providers such as a physical exam counts toward your deductible.

Once Blue KC processes the claims we receive from your providers showing the payments that you have made for covered healthcare services, we apply those payments toward your deductible. You can continue to use the funds in your account tax-free for out-of-pocket health expenses. If you enroll in Medicare, you can use your account to pay Medicare premiums, deductibles, copayments and coinsurance under any part of Medicare.

If you have retiree health benefits through your former employer, you can also use your account to pay for your share of retiree medical insurance premiums. The one expense you cannot use your account for is to purchase a Medicare supplement insurance or "Medigap" policy. Under the last-month rule, if you are an eligible individual on the first day of the last month of your tax year , you are considered an eligible individual for the entire year.

You are treated as having the same high-deductible health plan coverage for the entire year as you had on the first day of that last month. The total contribution for the year can be made in one or more payments at any time up to your tax-filing deadline . However, if you wish to have a contribution made between January 1 and April 15 treated as a contribution for the preceding tax year, please contact the HSA bank. You cannot use HSA funds to pay for qualified medical expenses incurred before you enrolled in a high-deductible health plan. In order to establish an HSA, you must enroll in a high-deductible health plan. Your eligibility to contribute to an HSA is determined by the effective date of your high-deductible health plan coverage.

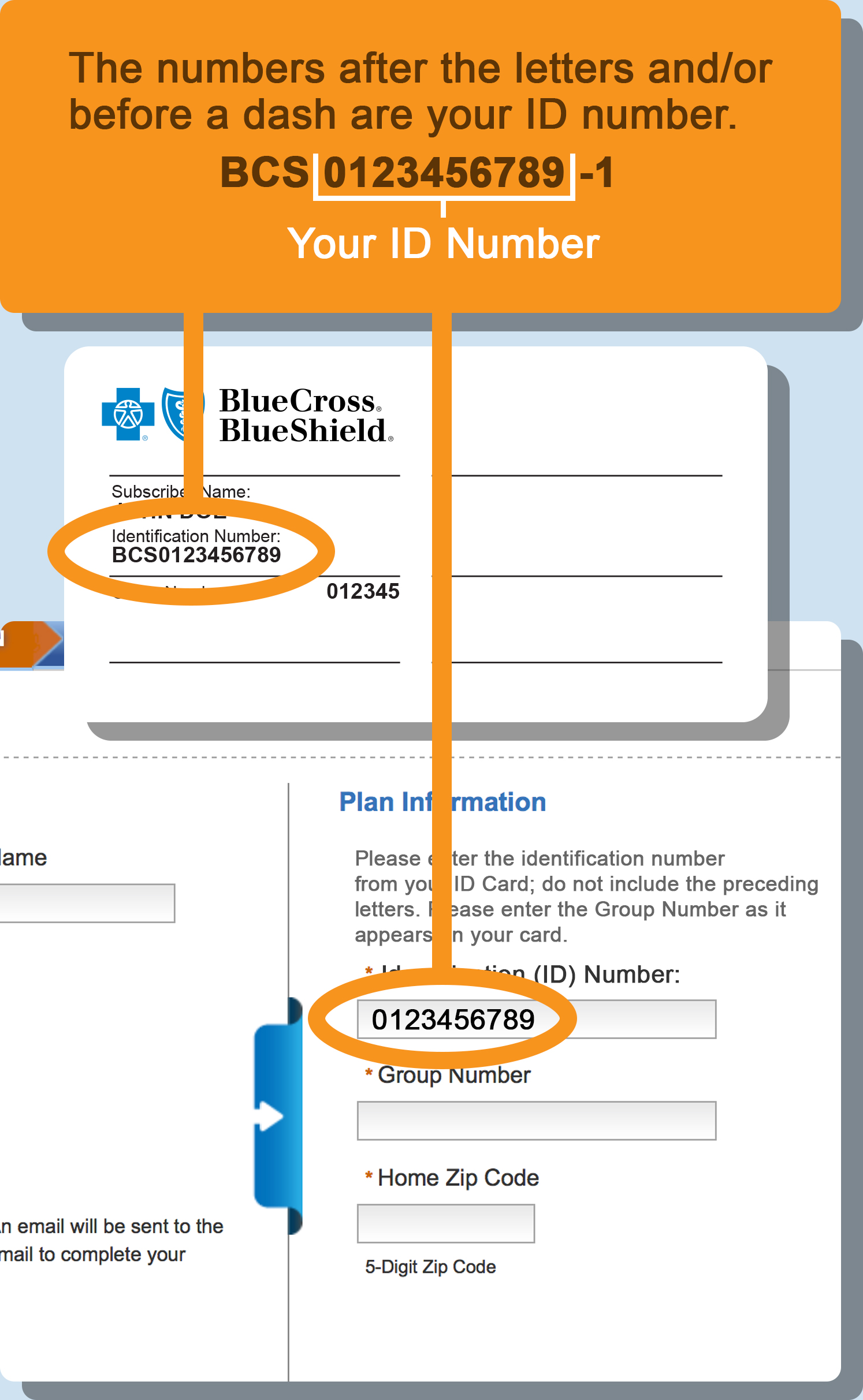

To change a PCP, log in and visit you Profile by clicking on the icon by your name in the top right corner of your homepage. In the Coverage Information section you'll see a list of covered members for your Blue KC policy. From here select "Change PCP" for the appropriate member and you can search for and designate a new PCP. Once we have processed your PCP change request, we will send you a new member ID card that contains the information of your newly selected PCP.

You may also call the Customer Service number listed on your member ID card to change your PCP. Please note that if you have health insurance through your employer, you may be required to contact your group benefits administrator to change your PCP. Sometimes providers send statements to their patients before Blue KC has finished processing and paying the claim. You might see a note on the bill that says "Insurance Pending." We will send you an Explanation of Benefits once we have processed your claim. If you are still unsure if you owe the provider, call their billing office. Please note, if your provider was not in the Blue KC HMO network, you will be responsible for paying all services and fees for seeing that provider.

You can view your EOBs and details about your claims, including how much you owe, by logging in and visiting the Claims and Usage section. WHA offers affordable, quality health care to its neighbors in Marin, Napa, Sacramento, Solano, Sonoma, Yolo and parts of Colusa, El Dorado, Humboldt, and Placer counties. UnitedHealthcare Signature1 - The Signature plan includes our full network of contracted providers.

With this HMO plan, members simply choose a primary care physician from our full network of contracted providers to coordinate all their medical care. They can then visit their PCP for routine checkups, and when they need to see a specialist, their PCP provides a referral. Members are charged only a copayment for each doctor's visit. The MetLife DHMO plans provide access to a large network of dental providers throughout California. Preventive dental care is an important part of overall health and MetLife is committed to ensuring that its members receive a high level of dental care.

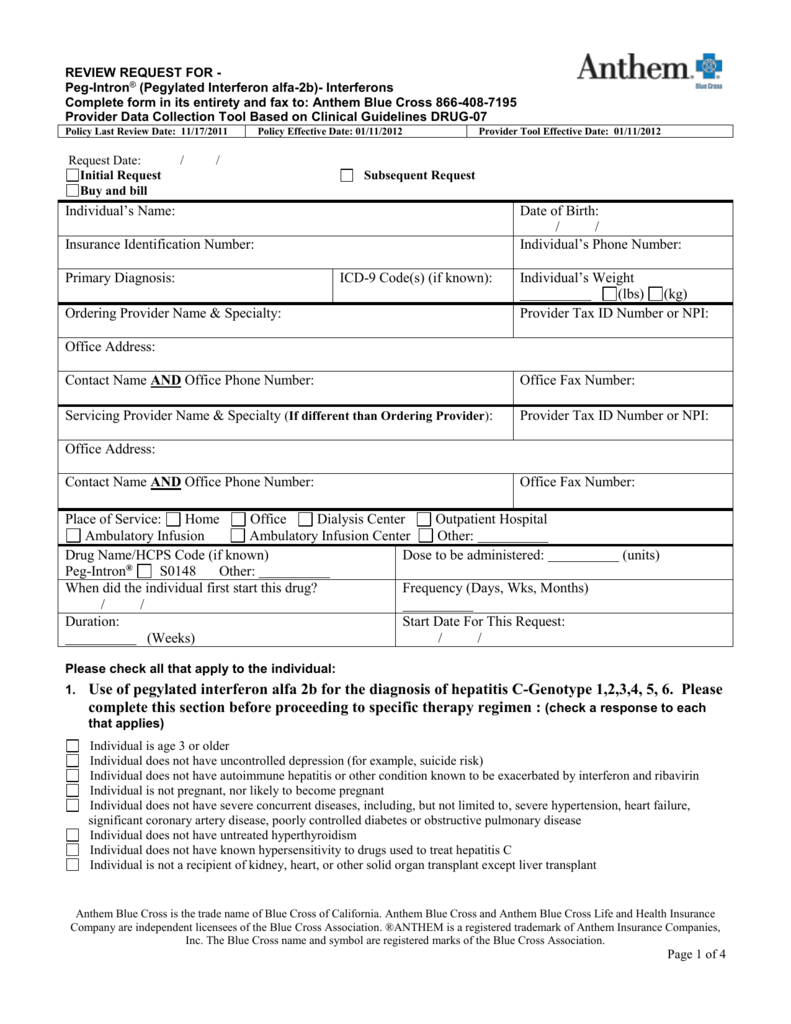

As part of this commitment, all Quality Management Activities are designed to meet or exceed NCQA standards. These standards are applied to plan design, through the credentialing of network providers, member services standards and on-going peer review and facility audits. If you use an in-network provider, you don't need to file a claim — your doctor will file one with Anthem. Anthem will then pay your doctor amounts it covers under the Health Account Plan and send you an Explanation of Benefits . The health care network specified by your Anthem insurance policy will determine whether you have access to in-network providers in other states. When submitting an out-of-state claim, you must contact Anthem's customer service department because the process may be different.

When you elect the Anthem PPO HDHP, you are also eligible to elect a Health Savings Account , a special tax-advantaged bank account to help cover your out-of-pocket healthcare costs. You might see another list with 2 different percent amounts. The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent.

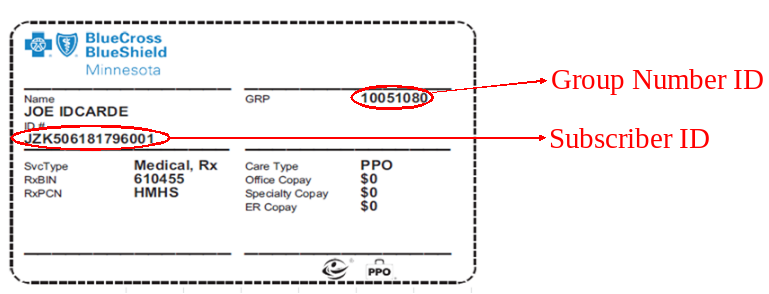

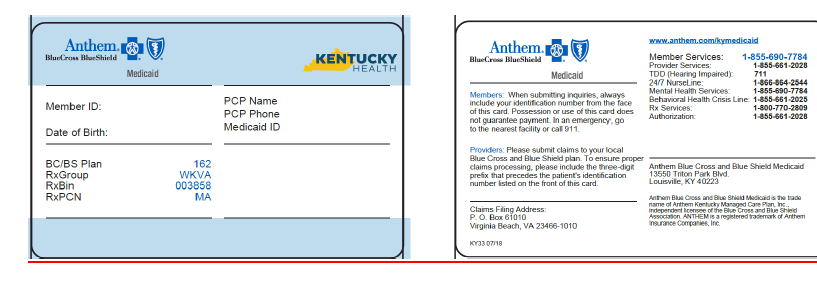

For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know. Call your insurance provider's customer service number and a representative should be able to help you. Your health insurance policy number is typically your member ID number. This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility. Centura Health accepts and bills most major insurance companies as a source of payment.

However, some of their benefit plans do not cover treatment at some Centura Health locations. It is recommended that you contact your insurance company directly if you have any questions about coverage at a Centura Health location. The maximum amount that may be contributed to your HSA for any year is a certain amount established annually by the IRS. This amount depends on whether you have individual or family coverage under your qualified high-deductible health plan.

The same annual contribution limit applies regardless of whether the contributions are made by an employee, an employer or both. If the provider you saw is out-of-network you will be responsible for paying the provider directly. We will send you a payment for the amount that is covered by your plan. With Sutter Health Plus, members gain access to an integrated network of high-quality healthcare providers, including many of Sutter Health's hospitals, doctors and healthcare services.

When you go to an appointment with your health care provider, they will ask you for your insurance information. If you use an out-of-network provider, you may need to pay your doctor up front and then file a claim with Anthem. Anthem will then pay your doctor amounts it covers under the HAP and send you an EOB. If you elected the Health Care Flexible Spending Account , the money in your FSA will be used first to reimburse you for any out-of-pocket health care expenses—since the FSA has a "use-it or lose-it" rule.

Where Is The Policy Number Located On Anthem Insurance Card HealthEquity | WageWorks administers your FSA and will automatically debit your FSA first to pay for any out-of-pocket medical expenses. If you don't have enough in your FSA to cover the expenses, HealthEquity | WageWorks will then debit your Health Account. Health coverage through Anthem offers access to an extensive network of providers for all your medical, prescription drug and mental health care needs. It is assigned to your employer by the insurance company and can also be beneficial for both you and your health care provider in finding out what your coverage entails and submitting claims. Routine Preventive care is a care benefit that is not subject to a deductible. Distributions used for any other purpose are includable in income and may also be subject to an additional 20 percent tax.

This 20-percent penalty tax does not apply to distributions made after your death, disability or attainment of age 65. A deductible is the amount that you are responsible for paying annually for healthcare services. Exceptions are outlined in your Blue KC certificate, which lists the exclusions related to your health insurance plan.

A copayment, or copay, is the dollar amount that you pay to a provider at the time you receive a service. For example, you might pay a $30 copay each time you visit your allergy doctor. The copay amount is defined in your Blue KC certificate, which outlines your responsibilities for health insurance plan payments. Allowable charges are the maximum amount payable to you under your health insurance plan for a particular service.

Contracted providers have agreed to accept this amount as payment in full. For example, if the provider charges $100 for a service and Blue KC pays $80 as the allowable charge, the provider cannot ask the member to pay the remaining $20. Keep in mind, however, that some health insurance plans have coinsurance. In those cases, members are required to pay a percentage of the allowable charge. For specific details about your plan, review your Blue KC certificate, which outlines your payment responsibility. There are two times you can make a change to your enrollment options.

Your employer schedules an open enrollment period once a calendar year when all employees may make changes to their health insurance plan. You may also make a change during a special enrollment period if you acquire a new dependent or if your coverage is terminated under another health insurance plan. If you have health insurance through an employer, your group benefits administrator, typically someone in your Human Resources department, can help you make changes to your health insurance plan.

If you do not have health insurance through an employer and instead pay your monthly premiums directly to Blue KC, call the Customer Service number listed on your member ID card. When you see an out-of-network provider, we send a check to you for the covered amount of those services. We will send you an EOB that explains how that amount was calculated. Our Signature plan offers access to a full network of contracted providers with more than 62,590 physicians and health care professionals, and 273 hospitals. The Advantage, Alliance and Harmony plans offer the same level of benefit coverage as our Signature plan but has a narrower network of contracted providers. You can find listings for physicians and hospitals in our provider directories.

UnitedHealthcare of California is committed to providing quality coverage and affordable benefits to help keep you and your family healthy. Our plans offer more than just doctor visits; preventive care services are also provided for every member of the family. Behavioral health benefits are provided through Anthem Blue Cross.